|

|||

|  |

|

|

Guest Columns

Perspective:

Dairy Markets

The coming wall of cheese

Mike McCully

Mike McCully is owner of McCully Consulting, South Bend, Indiana, and contributes this column for Cheese Market News®.

|

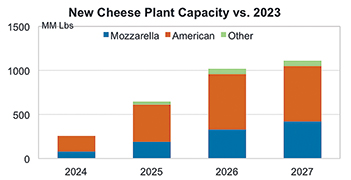

The coming wall of new cheese production capacity is getting closer, with several plants projected to start up in Q4 2024 and Q1 2025. The largest of these have received most of the attention, while others are less known but still add to the overall total. By late 2026/early 2027, there is an estimated increase of over 1 billion pounds of new cheese capacity coming online. Keep in mind this is “gross” as the “net” increase will be less as some plants close and others either shift their production mix or reduce volumes.

To put 1 billion pounds of cheese in perspective, the U.S. produced 14.2 billion pounds of cheese in 2023. The increased capacity by 2027 represents about an 8% increase versus 2023. While this sounds like a huge jump in cheese supplies, the 8% increase spread over four years is about the same as the 10-year average growth rate of 2.1%. However, the timing of the increase is important as most of the volume will come online over the next two years. During 2025, given projected timing of plant start-ups and ramp-ups, there could be an incremental 350-plus million pounds of cheese, with around 250 million pounds of American and 100-plus million pounds of Mozzarella and other styles versus 2024 production.

A common question has been: “Where will the milk come from for these new plants?” Companies are not investing hundreds of millions of dollars in new plants and expansions and then wondering where they will get milk from. Most, if not all, of these companies locked in future milk supply commitments before construction even started. The more relevant question is: “Who won’t get the milk?” In some regions, plants will fight for milk with higher premiums. There could be plants that don’t get all the milk they need or have been used to getting. Plants that perform balancing functions for certain regions will likely handle less milk, presenting challenges to their operational efficiency and financial performance.

More cheese also means more whey. For sweet whey powder, the combination of one plant closing and one opening results in only a small increase in production in 2025 with more growth expected in 2026. There are four plants with additional whey protein concentrate 80 capacity coming online in Q4 2024 through 2025 with an estimated increase of 10% or more versus 2023, and four plants with additional whey protein isolate capacity that adds close to 10% versus 2023. With more whey production coming online in 2025, prices are forecast to move lower from current levels but hold above long-term averages.

Once these plants start making cheese and whey, the question becomes: “Where will it all go?” For cheese, over the last five years, total commercial disappearance increased 250 million pounds on average, with domestic disappearance growing 210 million pounds and exports up 40 million per year, on average. Granted, this includes some noise from 2020-21 COVID and recovery periods. But the point is, the demand for cheese is increasing. In simple terms, the U.S. needs a new plant each year that processes 7 million pounds of milk per day to keep pace with demand growth for cheese. In 2025, there could be an extra 100 million pounds of cheese to find a home for. The market will work to balance supply and demand, with exports being a key part of clearing the additional product.

What does this mean for cheese prices? The outlook into 2025 will be a function of where prices are trading in Q4. If cheese prices hold in the $1.70s-$1.80s to year end, the weight of additional cheese could pull prices down to the $1.50s-$1.60s. But if the starting point is lower, the likelihood of sub-$1.50 cheese increases. And that would bring sub-$15 per hundredweight Class III milk, a price that could risk losing cows and milk. Lower feed costs, if realized, would help soften the blow, but only for so long.

While most of the industry talk surrounds additional cheese and whey capacity, there are also significant investments occurring in extended-shelf-life (ESL) and aseptic packaged milks. These products include specialty dairy beverages as well as non-dairy beverages, categories that are seeing innovation and growing consumer demand.

Within a few years, the U.S. dairy industry will see over $7 billion in investments in new plants and plant expansions. This is an unprecedented level of investment and one that shows companies are bullish about the future of dairy in this country. While there will be challenges along the way, for those with the interest and ability to invest, there will be opportunities to fulfill growing demand for dairy, both in the U.S. and around the world.

CMN

The views expressed by CMN’s guest columnists are their own opinions and do not necessarily reflect those of Cheese Market News®.

| CMN article search |

|

|

© 2025 Cheese Market News • Quarne Publishing, LLC • Legal Information • Online Privacy Policy • Terms and Conditions

Cheese Market News • Business/Advertising Office: P.O. Box 628254 • Middleton, WI 53562 • 608/831-6002

Cheese Market News • Editorial Office: 5315 Wall Street, Suite 100 • Madison, WI 53718 • 608/288-9090