|

|||

|  |

|

|

Guest Columns

Perspective:

Dairy Markets

Happy Thanksgiving, please pass the Ozempic

Dave Kurzawski

Dave Kurzawski is a senior broker with StoneX Group Inc.*, Chicago, a global financial services firm offering customized plans and tools to help clients protect margins and manage volatility. He contributes this column exclusively for Cheese Market News®.

|

Ahh Thanksgiving — that special time when we are prone to overeat and prone to judge our relatives for loading the dishwasher incorrectly. Oh yes, and hopefully we give a little genuine gratitude for the good things we all have in life.

While we have a lot to be thankful for in the dairy industry, the seasonal “bump” to cheese demand is lackluster at best. There are likely many reasons for this, among them a shift in willingness to own extra cheese — or anything for that matter — given the higher cost of money. But there is something else going on out there at the consumer level that doesn’t get enough airtime. There seems to be a strange wind blowing through grocery store aisles these days. No, I’m not talking about the anti-animal folks gaining a stronger foothold at the checkout counter (they don’t seem to be). I’m talking about semaglutides.

Semaglutides are relatively expensive injectable drugs and the latest craze in weight loss. You may know them by their brand names: Ozempic and Wegovy. Brought to you by Novo Nordisk and originally marketed to people with Type 2 diabetes, these drugs have gained a foothold with the otherwise healthy weekend warrior who wants to lose 20-30 pounds.

In September of this year, CNBC reported, “U.S. health care providers wrote more than nine million prescriptions for Ozempic, Wegovy and similar diabetes and obesity drugs during the last three months of 2022.” According to analytics firm Trilliant Health, that’s a 300% increase over three years ending December 2022.

And it’s effective. One of the ways they work is by slowing the gastric emptying, so the food sits in your stomach longer before it goes into your intestines. You feel full longer, you eat less (you buy less) and you lose weight. Nine million people (and likely growing) are taking a drug that kills your appetite.

This phenomenon has perhaps more far-reaching implications for the U.S. economy than immediately meets the eye. For instance, a Forbes article this month cited growing interest from the C-suite of fitness gyms: “Life Time Group President Jeff Zwiefel told CNBC last month his high-end gym chain is beginning a pilot program to use in-house medical professionals for an “integrated” approach to deliver the injectables to their members, while Anthony Geisler, CEO of Club Pilates and Pure Barre parent Xponential Fitness, cited the ‘early’ potential of Ozempic boosting growth in an (recent) earnings call.”

The theory goes like this: People lose some weight on these drugs, feel better and start working out again. But while gyms see a potential boon (which could underpin the already high priced whey protein markets), the dairy industry broadly is facing an external factor that stymies appetites and food sales.

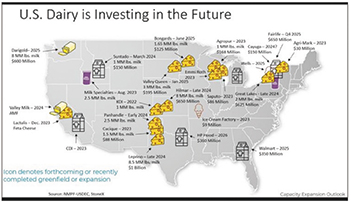

And it couldn’t come at a worse time as dairy manufacturers ramp up production capacity with an onslaught of expansions and greenfield developments nationwide.

The implications written heretofore are slowly killing any bullish sentiment for 2024 (and we haven’t even discussed the broader economic headwinds for next year in this article). But before we throw a bearish wet blanket over the U.S. dairy markets because of weight loss drugs and new plants, it’s important to remember that this dynamic is just one in a host of other supply/demand fundamentals that dictate final prices.

U.S. and global milk production remains subdued, heifer replacements are too costly and capital investment on dairy farms is quite slow. In fact, in over 20 years of helping the dairy industry manage price risk, I don’t know that I’ve ever seen such a disparity between desire to expand dairy product production and desire to be a dairy farmer.

The milk will eventually come, but competition for available milk will likely come first. If you buy milk to process, that may be one of your biggest hurdles in 2024. And if you have plenty of milk to run your plant today, be thankful for that this year. As for Ozempic and Wegovy, well, I’ll write a follow up down the road about all these skinnier people feeling light enough and confident enough to stop the drug. Unfortunately, we all know what happens when people go back to their old ways.

CMN

The views expressed by CMN’s guest columnists are their own opinions and do not necessarily reflect those of Cheese Market News®.

*This material should be construed as market commentary, merely observing economic, political and/or market conditions, and not intended to refer to any particular trading strategy, promotional element or quality of service provided by the FCM Division of StoneX Financial Inc. (“SFI”) or StoneX Markets LLC (“SXM”). SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences. These materials represent the opinions and viewpoints of the author, and do not necessarily reflect the viewpoints and trading strategies employed by SFI or SXM.

| CMN article search |

|

|

© 2025 Cheese Market News • Quarne Publishing, LLC • Legal Information • Online Privacy Policy • Terms and Conditions

Cheese Market News • Business/Advertising Office: P.O. Box 628254 • Middleton, WI 53562 • 608/831-6002

Cheese Market News • Editorial Office: 5315 Wall Street, Suite 100 • Madison, WI 53718 • 608/288-9090