|

|||

|  |

|

|

Guest Columns

Perspective:

Dairy Markets

A word on U.S.-EU tariffs

Nate Donnay

Nate Donnay is the director of dairy market insight at INTL FCStone* and has been applying his interest in complex systems and statistical analysis to the international and U.S. dairy markets since 2005. He contributes this column exclusively for Cheese Market News®.

October 18 marked the first day of the new $7.5 billion U.S.-EU tariffs resulting from a 15-year battle over aircraft subsidies paid by the EU to Airbus which have been ruled illegal by the World Trade Organization (WTO). Since April we’ve been waiting for the WTO to determine the financial damages that EU subsidies to Airbus have caused the United States. The United States claimed $11 billion; the ruling from the WTO is $7.5 billion. With that ruling, the United States now can collect an additional $7.5 billion per year in tariffs on EU products.

|

|

Back in April the U.S. government released a list of EU products, including cheese, butter and yogurt, which it proposed placing an additional tariff on. In July, the U.S. government expanded that list to include more varieties of cheese, butter blends and whey protein concentrate (WPC).

Earlier this month the United States released the official list and, instead of applying additional tariffs to dairy products from all EU-28 suppliers, the tariffs are selectively placed on individual countries. For instance, only WPC from Germany, Spain and the United Kingdom is hit with an additional tariff while butter from France and Poland will not face an additional tariff. This greatly complicates the data analysis. With 54 different HS codes across 25-28 countries being hit with additional tariffs, you have to pull about 1,400 data points for every time period you analyze.

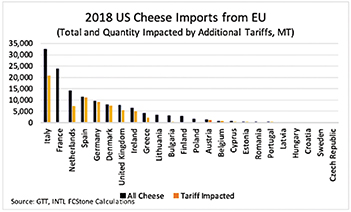

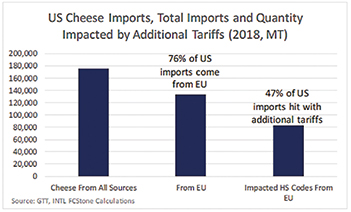

The amount of cheese being hit with additional tariffs is less than expected. Last year, 76% of U.S. cheese imports came from the European Union, but only 62% of that cheese is facing additional tariffs. That means additional tariffs would be put on just 47% of total U.S. cheese imports.

Ultimately, the lion’s share of the impacts will be felt on Ireland for butter and Italy for cheese.

The United States is the largest export destination for EU cheese. Every 1% increase in the cost of imported EU cheese reduces imported volume by 0.25% to 0.35%. It stands to reason that the 25% tariff would reduce imported volumes of affected cheese by 6 to 9%, which would be 5,000 to 7,500 metric tons (11 to 16.5 million pounds).

What does this really mean? If U.S. cheesemakers switch away from Cheddar and toward specialty cheese due to lower imports of specialty cheese, that could support the CME spot market by somewhere between 1 and 3 cents/pound in the first few months that the tariffs are put in place with the impact likely tapering off to almost no impact on CME spot prices a year from now.

The impact on the butter market could be more interesting. Eighty-eight percent of U.S. butter imports are coming from the European Union, mostly from Ireland. Most of this is in retail packaging. Given that Kerrygold has risen to be the second largest butter brand in the United States (Land O’Lakes is the first), we’re pretty confident that most of the imports from the European Union are Kerrygold butter.

Figuring out how the tariffs will impact butter imports is tricky. When we model the price sensitivities and assume a 25% tariff, it slows U.S. import growth from 30% to 20%, which reduces imports by about 5,000 metric tons from what they otherwise would have been. If we assume that U.S. consumers increase their demand for domestic butter by 5,000 metric tons, it would boost U.S. butter prices by 3-6 cents/pound ($66-$132/metric tons). The reduction in EU exports of butter would knock a similar amount off their butter prices.

Placing additional tariffs on EU dairy products will reduce U.S. imports and that will be supportive for U.S. prices, but the ultimate impact on prices looks pretty small. How long are these tariffs going to stay in place? It might be awhile. The United States first brought the Airbus dispute to the WTO in 2004, and the European Union has continued to provide subsidies to Airbus for the past 15 years. Soon the WTO will be making a ruling on the additional tariffs the European Union can place on the United States due to U.S. subsidies given to Boeing. This fight is going to escalate further before it gets resolved.

CMN

The views expressed by CMN’s guest columnists are their own opinions and do not necessarily reflect those of Cheese Market News®.

*Comments in this article are market commentary and are not to be construed as market advice.

| CMN article search |

|

|

© 2025 Cheese Market News • Quarne Publishing, LLC • Legal Information • Online Privacy Policy • Terms and Conditions

Cheese Market News • Business/Advertising Office: P.O. Box 628254 • Middleton, WI 53562 • 608/831-6002

Cheese Market News • Editorial Office: 5315 Wall Street, Suite 100 • Madison, WI 53718 • 608/288-9090