|

|||

|  |

|

|

Guest Columns

Perspective:

Dairy Pricing

Is there a better way to price milk?

Dr. John Newton

Dr. John Newton is chief economist for the American Farm Bureau Federation. He contributes this column exclusively for Cheese Market News®.

For nearly 20 years, federal milk marketing orders (FMMO) have established the minimum regulated price of milk based on end-product pricing formulas. Rather than all-out price reform, make allowances — an element of existing milk pricing formulas — are rumored to be the subject of upcoming policy discussions as they have not been reviewed in more than a decade.

|

|

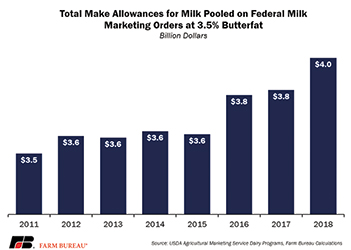

Intended to reflect the average processing costs associated with producing commodity dairy products, make allowances reduce the farm-value of milk by billions of dollars each year. Over the last eight years make allowances have represented nearly $30 billion — and in 2018 totaled $4 billion. Make allowances are a subsidy-like credit from dairy farmers to milk processors designed to cover all or a portion of the processing costs associated with making cheese, butter, nonfat dry milk or dry whey.

For some, the rationale behind these make allowances is price circularity in the supply chain, since the price of wholesale dairy products sold by plants is then used by USDA’s mandatory price reporting survey to determine the price these plants pay for milk. As a result, a processing credit to cover the costs of turning raw milk into a wholesale dairy product is necessary to ensure profitability. Updating these make allowances, some propose, will realign them with the costs of building and operating a dairy processing plant.

While that reason makes sense on the surface, it’s worth more closely examining how much price circularity exists by measuring the volume of dairy products captured in USDA’s survey. If only a small percentage of cheese, butter and dry milk powders are captured in the survey, then the case for updating make allowances should be further scrutinized — and while we’re at it, we could consider a better way to price milk.

• Do we have price circularity?

Each week USDA’s Agricultural Marketing Service requires dairy product manufacturers to report sales prices of wholesale dairy products meeting certain product specifications. For cheese, mandatory price reporting is required for 40-pound blocks and 500-pound barrels. The products must meet very strict specifications. For example, reporting is required only for cheese that is four to 30 days in age and reporting must exclude cheese sold under a forward contract or sold through an export promotion program.

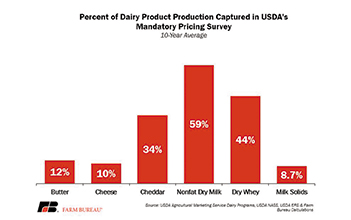

So how much of the cheese produced in the United States is captured in the mandatory price reporting survey? Of the 13 billion pounds of cheese produced in the United States in 2018, 1.2 billion pounds were captured in USDA’s price survey, indicating that 9 percent of the cheese produced in the United States was captured by the survey. When narrowing it to only Cheddar cheese produced, 32 percent was captured in USDA’s price survey. This suggests that more than two-thirds of all Cheddar cheese and more than 90 percent of all cheese are not captured in the USDA survey. Over the last decade, 90 percent of cheese and 66 percent of Cheddar were priced outside of USDA’s survey — indicating there is not much price circularity in cheese.

What about butter or dry milk powders? Over the last decade, 88 percent of butter produced in the United States was priced outside the scope of FMMOs and 56 percent of dry whey production was not captured by USDA’s mandatory price survey. The only product for which most of the transactions were captured in the FMMO survey — 60 percent — was nonfat dry milk.

What about milk solids? USDA reports the butterfat content in milk produced, which gives us a basis for inferring the total solids produced in milk. Using standard conversion factors, it is possible to convert the dairy products captured in USDA’s survey to a milk solids equivalent. Over the last decade, U.S. milk solids production totaled nearly 260 billion pounds, and the total milk solids in all the products captured in the mandatory price reporting survey were 22 billion pounds — indicating that less than 9 percent of U.S. milk solids production was captured in FMMO pricing surveys.

So, we now know that a small percentage of the dairy products produced in the United States are used to set regulated minimum milk prices. We also know that only regulated fluid plants and pooled manufacturing plants buying milk from independent producers have to pay these FMMO minimum prices. Manufacturing plants buying milk through a cooperative or cooperative-owned plants are not required to pay FMMO minimum prices, rather when pooling they are beholden to the pool at the classified value.

• Is the tail wagging the dog?

While the FMMO regulates prices for 80 percent of the milk in the United States, less than 10 percent of milk solids are surveyed to set those prices, and only a subset of handlers are subject to those regulated minimums.

Where are the rest of the milk solids in the milk price universe? Perhaps they are in 640-pound cheese blocks or value-added and aged cheese. Mozzarella certainly is a sizable share, and there also are branded butter, specialty yogurts, ice creams or branded and value-added beverage milks. We forgot about permeates, concentrates, fractions and isolates. Where is the farmer’s share of those new, innovative and value-added products and what’s the value of milk used to produce these products?

Is it possible these other new, innovative and value-added products not used for milk pricing regulations already have profit margin potential for processors? If so, let them contribute to the price discovery process for milk in manufacturing classes. Are there profit opportunities for milk sold below the regulated minimum price? There could be. This is not to say make allowances shouldn’t exist, but rather should regulation-induced profitability be discarded in favor of flexible make allowances determined in a free market?

Milk could be priced to reward efficiency, innovation and risk taking among processors, cooperatives and dairy farmers. It would a big step forward, but while we’re on the subject of make allowances why not think bigger?

CMN

The views expressed by CMN’s guest columnists are their own opinions and do not necessarily reflect those of Cheese Market News®.

| CMN article search |

|

|

© 2025 Cheese Market News • Quarne Publishing, LLC • Legal Information • Online Privacy Policy • Terms and Conditions

Cheese Market News • Business/Advertising Office: P.O. Box 628254 • Middleton, WI 53562 • 608/831-6002

Cheese Market News • Editorial Office: 5315 Wall Street, Suite 100 • Madison, WI 53718 • 608/288-9090