|

|||

|  |

|

|

Guest Columns

Perspective:

Market Insight

The roller coaster that is the Class III/Class IV spread

Andrew Faulman

Andrew Faulman is a floor manager at Rice Dairy.* He is a guest columnist for this week’s Cheese Market News®.

The past couple of years have seen some of the most price volatility the dairy market has ever experienced. From $2.40 cheese to $3.00 butter, large price swings seem to have become commonplace. What that has done to the implied price of milk has been another story. From nonfat putting in record lows to butter putting in record highs, the Class III / Class IV spread has seen $4.00 differences since the start of the year. With butter prices on the move again, one thing seems to be the common denominator: Volatility is here to stay.

We started the year out with some news pieces that spurred price volatility in spot markets and caused the first intersection between Class III and Class IV. Talks of a potential drought in New Zealand seemed to spur buyers into action at the Chicago Mercantile Exchange (CME). Both the spot cheese and nonfat markets responded with strength, causing the difference between Class III and Class IV to trade at a spot equivalent of zero. However it was the nonfat market that seemed to be the biggest driver for the first portion of volatility in this spread.

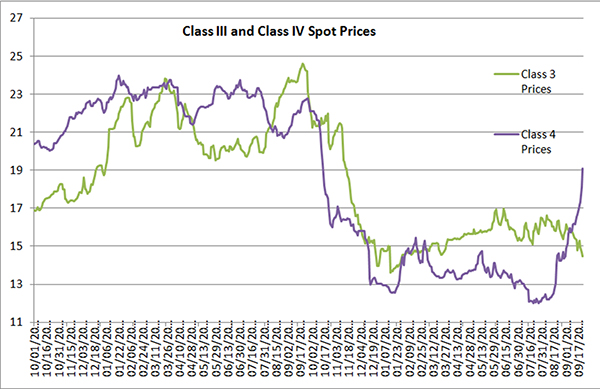

Recall earlier in the year that a burdensome level of inventories in the nonfat market seemed to weigh on prices, both domestically and internationally. Markets like the CME as well as the Global Dairy Trade Auction (GDT) were trending lower to where record low prices were printed in both markets. As seen in the chart on this page, we saw the difference between the two get to $4.42! Take this and add in a rally into the $1.70s in the cheese market during that time frame, and the stage was set for more fireworks as this spread historically does not stay this wide for very long.

Volatility has a tendency to breed further volatility and in this case there was no exception. On Aug. 18 GDT saw the first percentage increase of the year, marking the start of a rally off record low prices. Since then, every week the GDT auction has moved higher and with it the spot nonfat market at the CME. Rallying from $0.69 up to just north of $1.10, the price of nonfat was again in the spotlight for driving the spread between Class III and Class IV.

Meanwhile, leading up to the summer months, butter at the CME had traded anywhere from $1.54 to $2.06, a sizeable amount of price action for any year. That, however, was only a prelude to what was to come. Last year butter prices put in a record at $3.06, a price that felt unbelievable at the time. That record didn’t last very long, though, as 2015 brought us another rally in butter, this time up to $3.14. While what goes up must come down, the reasoning for this year’s move may be something that changes the dynamics of the butter market for years to come.

In an announcement that seemed to turn heads, McDonald’s has opted to not only serve breakfast all day, but to start using butter instead of margarine. Combine this with last year’s cover story article in Time magazine titled, “Eat Butter,” we’ve seen a resurgence in butter demand. What are the potential ramifications from this? One question that comes to mind is what will happen if other quick service restaurants decide to go down the butter path in the same fashion McDonald’s has? What sort of ripple effects will we see across the dairy industry?

Seeing the spread between Class III and Class IV move this much certainly presents both challenges and opportunities. From a supply/demand standpoint, balancing product can become a challenge when the Class I driver makes such a dramatic shift in a short amount of time; from Aug. 8 through September this spread rallied $9.04 with Class IV climbing over Class III. With Class III premium to Class IV for majority of the year and nonfat prices trading at record lows, we naturally saw a reduction of milk going into butter/powder plants, which in turn draws on the production of butter. This seemed to be the case when Class III was $4.00+ premium to Class IV, but what about when that spread flipped and Class IV climbed to a $4.00+ premium to Class III?

From a hedger’s perspective, one thing that sticks out to me is the nature in which the futures/options market responded to this shift. While the futures market in Class IV maintained a discount to its respective spot markets, the options market saw a sizeable increase in the implied level of volatility, particularly for butter.

Numerous factors comprise the actual pricing of calls and puts with one of the major factors being implied volatility. Expressed as a percentage, the implied volatility for butter options at one point reached more than 50 percent. This in turn caused a sizeable increase in the premiums for both calls and puts, making it more difficult for hedgers to purchase insurance against price action.

The only consistency one can rely on when looking at supply and demand in the dairy industry is that it always is changing. With new players entering the market and global markets like GDT becoming more widely used, we are seeing changes in dairy that are leading to increases in price volatility, both domestically and internationally. With increased participation comes greater price discovery which, in my opinion, makes the Class III/Class IV spread more of a viable indicator for shifts in supply and demand. Amidst an industry that is constantly changing and growing, look for the Class III/Class IV spread to be constantly changing along with it.

CMN

The views expressed by CMN’s guest columnists are their own opinions and do not necessarily reflect those of Cheese Market News®.

*These observations include information from sources believed to be reliable, but no independent verification has been made and therefore their accuracy and completeness cannot be guaranteed. Opinions and recommendations expressed are the opinion of the authors and are subject to change without notice. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. The views expressed by CMN’s guest columnists are their own opinions and do not necessarily reflect those of Cheese Market News®.

| CMN article search |

|

|

© 2025 Cheese Market News • Quarne Publishing, LLC • Legal Information • Online Privacy Policy • Terms and Conditions

Cheese Market News • Business/Advertising Office: P.O. Box 628254 • Middleton, WI 53562 • 608/831-6002

Cheese Market News • Editorial Office: 5315 Wall Street, Suite 100 • Madison, WI 53718 • 608/288-9090